eSports Statistics – By Market Size, Viewers and Demographics

Introduction

eSports Statistics: eSports, also known as electronic sports, encompasses the world of competitive, organized video gaming where professional players and teams battle it out in popular video games. This phenomenon has transformed gaming from a solitary hobby to a mainstream spectator sport, complete with live broadcasts and massive fan followings.

The industry has seen a meteoric rise in popularity, particularly in the past decade, driven by advancements in technology and streaming platforms like Twitch and YouTube, which have made it easier than ever to watch matches live. eSports covers various genres, including real-time strategy games, first-person shooters, and multiplayer online battle arenas, each drawing its own unique set of skills and fanbases.

The eSports industry is a grow rapidly global market. Twitch dominates the eSports streaming landscape with a market share of approximately 84%, maintaining its position through specialized features and strong community engagement tools.

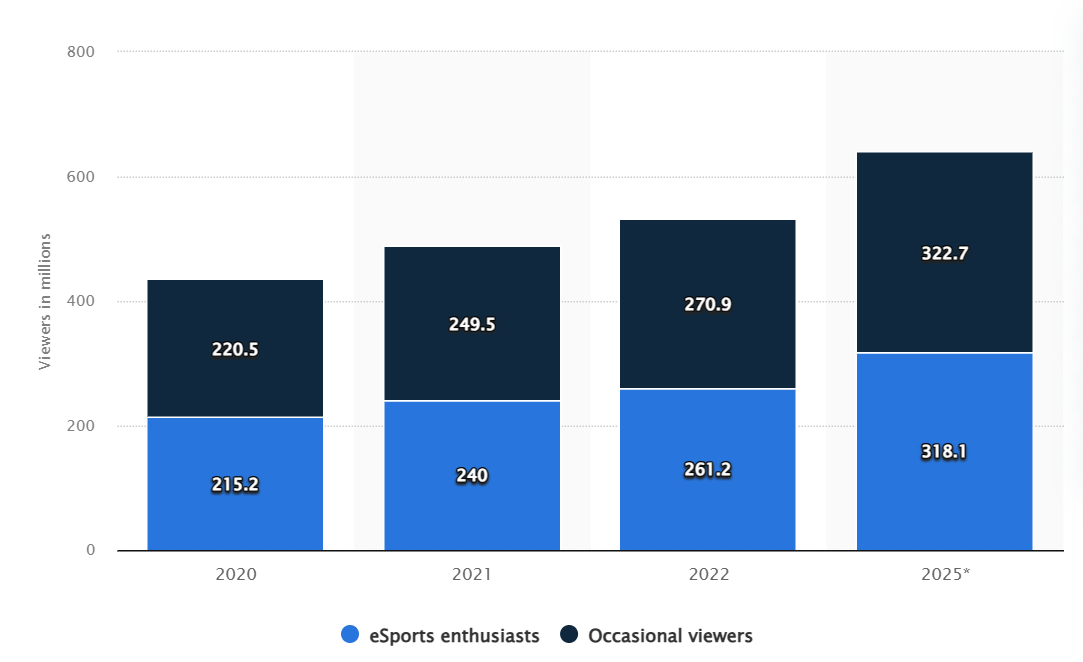

The global eSports audience is projected to exceed 318 million by 2025. This increase is fueled by the rising number of people watching eSports through live streams, with a considerable portion of internet users in regions like the Philippines, Indonesia, and India actively engaging in video game streaming. This trend underscores the expanding reach and appeal of eSports across diverse demographics globally.

Top Esports Statistics (Editor’s Picks)

- The esports industry boasts a market value of approximately $1.6 billion, reflecting its massive global appeal and commercial viability.

- As of 2025, the global esports audience is projected to reach about 640.8 million people. This audience consists of 322 million occasional viewers and 318 million dedicated fans, indicating a balanced mix of casual interest and hardcore engagement.

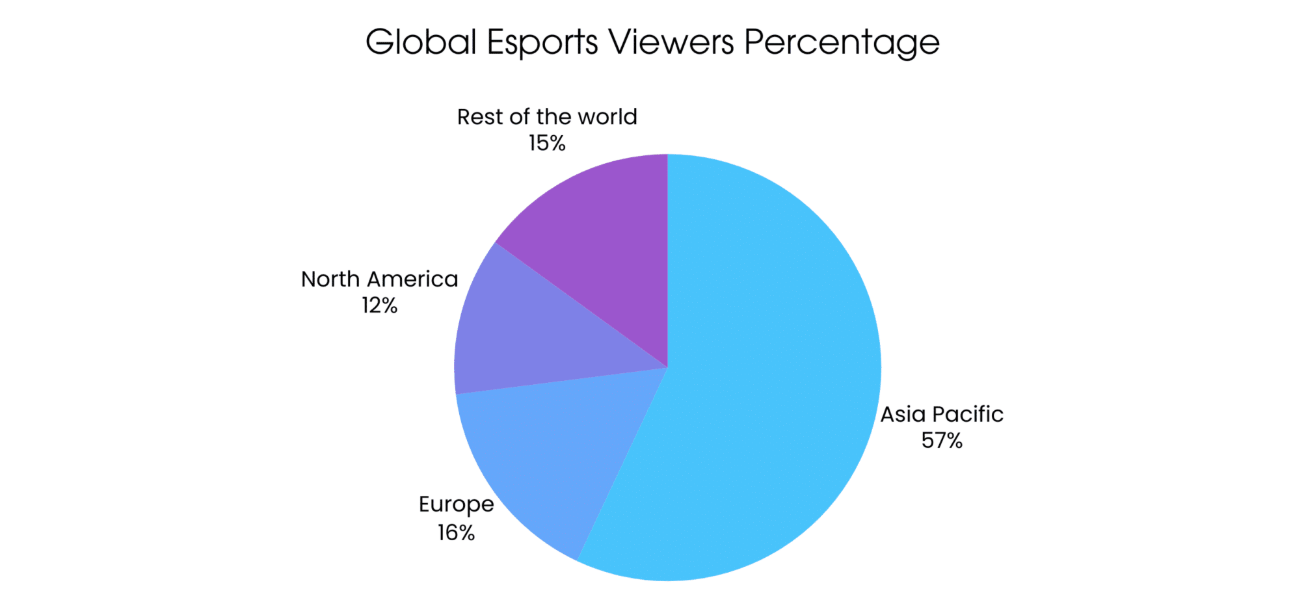

- Leading the global engagement, the Asia-Pacific region accounts for more than 57% of the total esports audience, showcasing the region’s strong affinity for competitive gaming.

- In the United States, there are 3,530 active esports players, highlighting the country’s role as a significant player in the esports arena.

- In the U.S., 70% of esports viewers are male, pointing to a predominant demographic but also suggesting room for more gender diversity in viewership.

- Team Liquid stands out with earnings of $44.08 million, making it the highest-earning professional esports team and a testament to the financial opportunities within the industry.

- TSM leads in valuation, worth $540 million, underlining the substantial economic impact and investment potential within esports teams.

- The top-earning player in the esports world has amassed over $7 million in winnings, showcasing the lucrative potential for top-tier talent in this competitive field.

- Notably, 40% of esports fans hail from China and the Philippines, emphasizing these countries’ pivotal contributions to the global fan base.

- While the esports fan base is robust, with 261 million contributing fans, their annual spending amounts to just $5.30 each. This figure is relatively low compared to traditional sports, indicating potential growth areas for revenue enhancement.

- Sponsors are crucial to the esports economy, contributing 60% of the revenue, which underscores the importance of corporate partnerships in sustaining and expanding the esports industry.

Esports Market Overview

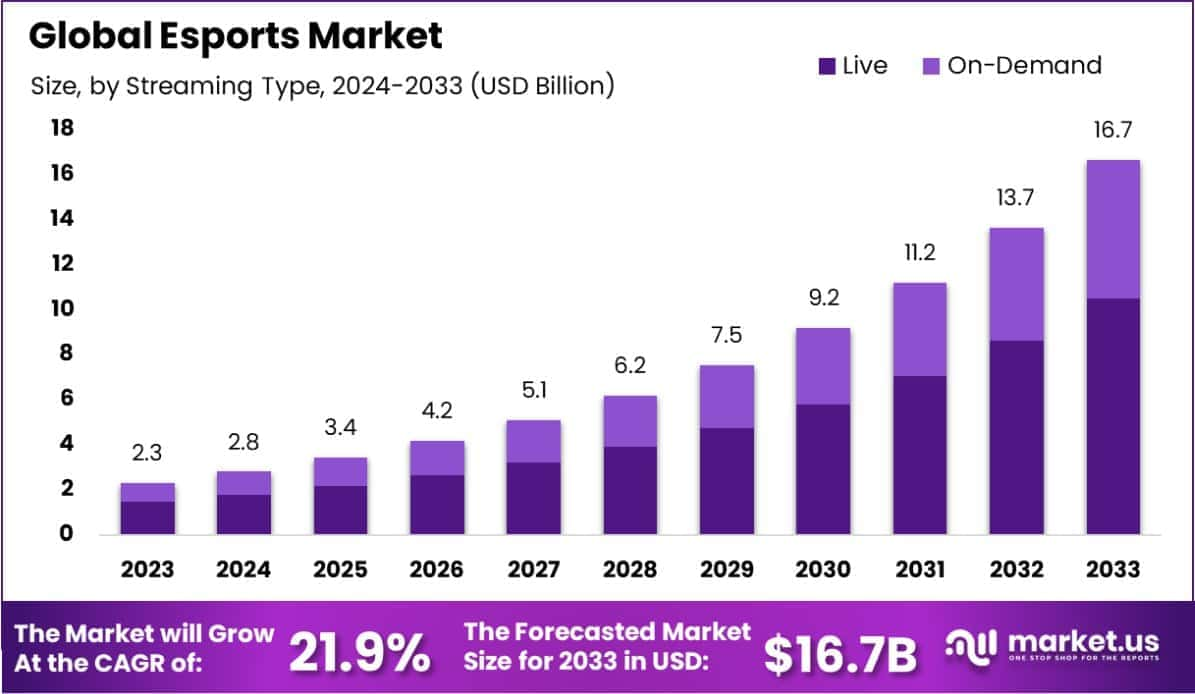

According to Market.us, By 2033, the global esports market size is anticipated to reach approximately USD 16.7 billion. This represents a significant increase from USD 2.8 billion in 2024, with an impressive compound annual growth rate (CAGR) of 21.9% from 2024 to 2033. This rapid growth underscores the expanding popularity and commercial potential of esports worldwide.

In 2023, North America maintained a leading position in the esports market, securing over 36.3% of the global share. This translates to revenue of USD 0.83 billion, highlighting North America’s critical role in the industry’s global economic impact.

Esports market growth over time:

| 2024 | $2.8 billion |

| 2025* | $3.4 billion |

| 2026* | $4.2 billion |

| 2027* | $5.1 billion |

| 2028* | $6.2 billion |

| 2029* | $7.5 billion |

| 2030* | $9.2 billion |

| 2031* | $11.2 billion |

| 2032* | $13.7 billion |

| 2033* | $16.7billion |

Source: Market.us

Esports Viewers Statistics

- 100 million+ viewers tune in for major esports tournaments, highlighting the industry’s vast global reach.

- The 2023 LCS Spring Season recorded a 13% drop in viewership, sparking concerns about esports growth in the U.S.

- 261 million esports fans contribute only $5.30 per year on average, significantly lower than traditional sports spending.

- The global esports audience is projected to exceed 640 million viewers by 2025, signaling continued expansion.

- 61% of gamers are male, while 30% are female, showing a strong male-dominated audience.

- Chinese esports demographics are shifting, with a rising audience in the 35-44 age group.

- The League of Legends World Championship was the most-watched esports tournament in late 2023, peaking at 6.4 million viewers.

- Major esports tournaments regularly attract over 2 million peak viewers, proving their massive popularity.

- Esports audiences are predominantly young:

- 32% are between 16-24 years old

- 30% are in the 25-34 age range

Source: statista.com

Esports Viewers by Region

- Asia Pacific dominates esports viewership, holding 57% of the total audience worldwide.

- With 1.5 billion gamers in Asia, it’s no surprise that the region has the largest share of esports fans.

- Countries like China and Indonesia contribute heavily to Asia’s dominance in esports viewership.

- The United States recorded 45 million esports viewers in 2023, showing strong but lower engagement compared to Asia.

- Europe ranks second in viewership, accounting for 16% of the global esports audience.

(Reference: demandsage.com)

Esports Statistics by Region

- 80% of esports fans come from the Asia-Pacific (APAC) region, reinforcing its dominance in the industry.

- The U.S. esports market is valued at $1.07 billion, making it one of the most lucrative markets globally.

- In comparison, China’s esports market is worth $497.6 million, significantly lower despite its large player base.

- Europe’s esports market is estimated at just $1.44 million, showing slower industry growth.

- As of 2024, North America holds a 37.2% share of the global esports market, solidifying its position as a key player.

- 20% of U.S. citizens in their 20s and 30s identify as serious esports fans, highlighting the growing interest among younger demographics.

- Over 50% of gamers worldwide come from the APAC region, further proving the region’s influence on the industry.

| Region | Market value |

| United States | $1.07 billion |

| China | $497.6 million |

| Germany | $299.5 million |

| France | $169.3 million |

Source: whatsthebigdata.com

Esports Financial Landscape

- Tencent Holdings remains the largest esports company globally, boasting a market capitalization of $472.33 billion as of December 2023. It is also among the top 20 biggest companies in the world.

- China led in esports prize earnings, with its players winning $37.78 million from tournaments in 2023.

- The U.S. dominated esports revenue, generating $871 million in 2023, while China followed with $445.18 million in earnings.

- Esports in China was valued at ¥16.22 billion in 2023, with projections indicating growth to nearly ¥20 billion by 2024—a 20% increase.

- Growth is expected to slow slightly between 2024 and 2025, reaching ¥21.78 billion by 2025.

- The Asia-Pacific region dominates gaming, with over 50% of the world’s gamers coming from APAC.

Esports Players and Teams Statistics

Top Esports Players by Earnings (Early 2025)

| Player | Earnings (USD) |

|---|---|

| Johan Sundstein (N0tail) | $7.18 million |

| Jesse Vainikka (JerAx) | $6.49 million |

| Anathan Pham (Ana) | $6.02 million |

| Sebastien Debs (Ceb) | $5.88 million |

| Topias Taavitsainen (Topson) | $5.72 million |

| Yaroslav Naidenov (Miposhka) | $5.63 million |

| Ilya Mulyarchuk (Yatoro) | $5.40 million |

| Magomed Khalilov (Collapse) | $5.39 million |

| Miroslaw Kolpakov (Mira) | $5.38 million |

| Kuro Takhasomi (KuroKy) | $5.29 million |

Leading Teams by Earnings

| Team | Total Earnings (USD) |

|---|---|

| Team Liquid | $48.8 million |

| TSM | $410 million |

| Cloud9 | $350 million |

10 Most Valuable Organizations

Top Esports Organizations by Estimated Valuation

| Rank | Organization | Estimated Valuation (USD) |

|---|---|---|

| 1 | TSM | $540 million |

| 2 | 100 Thieves | $460 million |

| 3 | Team Liquid | $440 million |

| 4 | FaZe Clan | $400 million |

| 5 | Cloud9 | $380 million |

| 6 | G2 Esports | $340 million |

| 7 | Fnatic | $260 million |

| 8 | Gen.G | $250 million |

| 9 | NRG | $240 million |

| 10 | T1 | $220 million |

Emerging Trends

- Mobile Esports Dominance: Mobile esports continues to grow rapidly, with titles like PUBG Mobile and Mobile Legends leading the charge. This trend is largely driven by improved mobile connectivity worldwide, making it easier for more players to participate from diverse regions.

- Virtual Reality (VR) Integration: VR is carving out a niche in esports, offering immersive experiences that enhance both player engagement and spectator viewing. Titles such as Echo VR and Population: ONE are at the forefront, showcasing the potential of VR in competitive gaming.

- AI-Driven Strategies and Training: The use of artificial intelligence is transforming coaching and gameplay strategies within esports. AI tools provide teams with deeper insights into game tactics and player performance, pushing the boundaries of traditional training methods.

- Inclusivity and Diversity: There’s a notable increase in the involvement of women in esports, supported by initiatives like the Valorant Game Changers, which promote female participation. This trend is enhancing the diversity of the esports community and broadening its audience.

- Educational Integration: Esports is increasingly being recognized as a valuable educational tool. Institutions are integrating esports into their curricula, offering scholarships, and using it to teach various STEM subjects, thereby legitimizing esports as a career path.

Top Use Cases

- Fan Engagement Through Betting: The esports betting market is expanding, with platforms integrating micro-betting and live wagering options that enhance viewer engagement and interaction during live events.

- Data Analytics for Performance Improvement: Teams and organizers are leveraging data analytics to enhance decision-making and improve player and team performances. This use of big data is setting new standards in how teams approach training and strategy.

- Global Tournament Expansion: The global reach of esports is increasing with more inclusive and expansive tournament formats that cater to a worldwide audience. This expansion is not only limited to popular games like League of Legends but also includes mobile games that dominate in regions like South Asia.

- Sustainable Revenue Models: The industry is exploring new monetization models beyond traditional advertising and sponsorships, including direct fan engagements and enhanced merchandising strategies.

- Technological Advancements in Broadcast: Advances in streaming and broadcasting technology are continually enhancing the viewer experience. Augmented reality (AR) and other broadcasting innovations are making it possible for fans to experience games in more engaging and interactive ways.

Major Challenges

- Financial Stability and Revenue Diversification: Many esports organizations still rely heavily on sponsorships and advertising, which may not be sustainable in the long run. Developing new monetization models that include direct fan engagement and alternative revenue streams remains a critical challenge.

- Technological Disparities and Accessibility: As esports grows, the gap in access to cutting-edge gaming technology and high-speed internet between developed and developing regions could limit the industry’s expansion. Ensuring equitable access is a major hurdle for global inclusivity.

- Regulatory and Legal Issues: The global nature of esports introduces complex legal challenges, including issues related to player contracts, tournament regulations, and betting. Navigating these complexities is essential for the industry’s legitimacy and operational success.

- Player Health and Wellbeing: The intense nature of professional gaming can lead to physical and mental health issues among players, such as burnout, repetitive strain injuries, and stress-related conditions. Addressing these health concerns is crucial for the sustainability of player careers.

- Market Saturation and Competitive Balance: As more organizations and investors enter the esports market, there is a risk of saturation, which could stifle innovation and reduce the overall competitiveness of the industry. Maintaining a balance between growth and competitive integrity is a significant challenge.

Attractive Opportunities

- Emerging Markets: Regions like South Asia and Africa, with burgeoning youth populations and increasing digital connectivity, present significant opportunities for market expansion and audience engagement in esports.

- Educational Programs: Leveraging esports as a tool for education provides opportunities for industry partnerships with educational institutions to foster talent and promote STEM learning, opening up new pathways for career development in technology and gaming.

- Women’s Participation: Increasing the involvement of women in esports through targeted tournaments and support programs offers a chance to broaden the market and enhance the diversity of the gaming community.

- AI and Advanced Analytics: The integration of AI and sophisticated analytics tools in esports operations—from player training to audience engagement strategies – offers teams and organizers the ability to enhance their competitive edge and operational efficiency.

- Virtual Reality (VR) and Augmented Reality (AR): Innovations in VR and AR can transform the spectator experience and open new avenues for interactive and immersive gaming, providing a fresh landscape for technological advancement in esports.

Conclusion

In conclusion, as we look towards 2025, the esports industry is poised on the brink of transformative growth, underscored by technological advancements and an expanding global footprint. However, this growth comes with its share of challenges, such as financial sustainability, regulatory complexities, and the need for inclusive access.

Addressing these challenges head-on will be key to leveraging the abundant opportunities in emerging markets, educational initiatives, and technological innovations. By navigating these waters wisely, esports can solidify its position as a major player in both the entertainment and technology sectors, promising a dynamic and inclusive future for players, fans, and stakeholders alike.

Source:

- https://www.esports-insights.com/top-5-esports-trends-in-2025-that-are-redefining-the-industry/

- https://www.coolest-gadgets.com/esports-statistics/

- https://escharts.com/news/esports-trends-2025

- https://computingforgeeks.com/the-future-of-esports-in-2025/

- https://esportsinsider.com/2025/01/esports-industry-predicts-2025

- https://lastwordongaming.com/2025/01/24/predicted-esports-developments-for-2025/

- https://www.globalbrandsmagazine.com/esports-industry-in-2025/

- https://www.22esport.gg/esports-predictions-2025/

- https://explodingtopics.com/blog/esports-statistics

- https://www.businessstartupqatar.com/news/qatar-esports-revenue-projected-457-5million/

- https://www.demandsage.com/esports-statistics/

- https://whatsthebigdata.com/esports-stats/

- https://www.statista.com/topics/3121/esports-market

- https://explodingtopics.com/blog/esports-statistics#regional-esports-stats

- https://www.skillademia.com/statistics/esports-statistics/

- https://influencermarketinghub.com/esports-stats/